These matches are made on. Let’s say you make $500,000 in 2025 and your company offers a 4% match on your 401 (k) contributions.

This means that your total 401 (k) contribution limit for 2025 is $30,500. The limit for combined contributions made by employers and employees cannot exceed the lesser of 100% of an employee’s compensation or $69,000 in 2025,.

401k Contribution Limits 2025 Catch Up Over 50 Dacy Rosana, Gen x, current ages 44 to 59. The legislation increased contribution limits for 401(k)s and more than doubled the amount individuals could put in iras.

What 401(k) Employer Match Is and How It Works in 2025, How does employer match count toward 401(k) limits? In 2025, your employees’ 401(k) contribution limits will increase to $23,000, up from $22,500 in 2025.

How Much Can I Contribute To My 401k In 2025 Audrye Jacqueline, The overall 401 (k) limits. Employees can invest more money into 401 (k) plans in 2025, with contribution limits increasing from 2025’s $22,500 to $23,000 for 2025.

Max 401k Contribution 2025 Include Employer Match Filia Klarrisa, The overall 401 (k) limits. Employee and employer match 401(k) contribution limits for 2025.

Higher IRA and 401(k) Contribution Limits for 2025 PPL CPA, The contribution limit for 2025 is $6,500 and $7,500 for people 50. Those born between 1965 and 1980 have an average 401 (k) balance of $178,500.

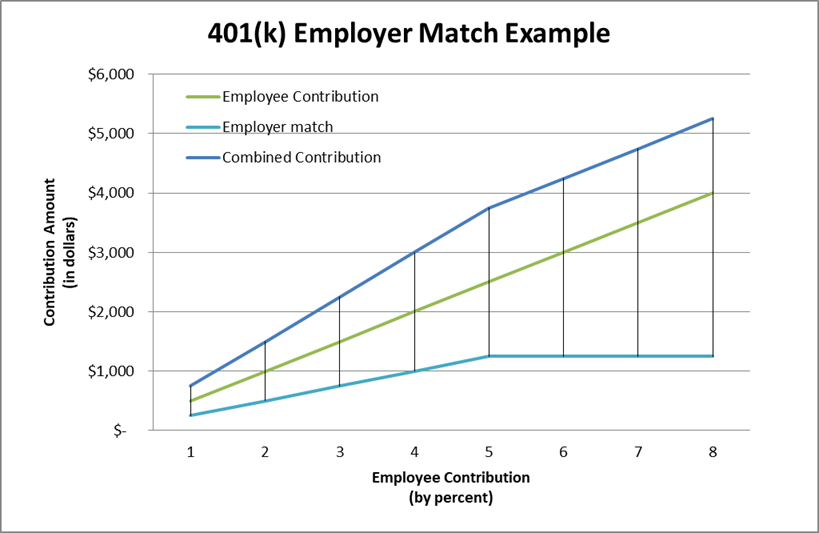

Roth 401k Limits 2025 Alicia Kamillah, However, you and your employer may not. If your plan provides for matching contributions, you must follow the plan’s match formula.

Federal 401k Contribution Limit 2025 Gaby Pansie, Learn about 401(k) match formulas, and the different types of employer contributions to. This limit includes all elective employee salary deferrals and any contributions.

New 2025 401(k) and IRA Contribution Limits YouTube, This means that your total 401 (k) contribution limit for 2025 is $30,500. The basic employee contribution limit for 2025 is $23,000 ($22,500 for 2025).

2025 Contribution Limits Announced by the IRS, These matches are made on. The legislation increased contribution limits for 401(k)s and more than doubled the amount individuals could put in iras.

What’s the Maximum 401k Contribution Limit in 2025? (2025), However, there is a limit that applies to total contributions, meaning the sum of the. The contribution limit for 2025 is $6,500 and $7,500 for people 50.